2022 Fall Letter

Dear Client,

After an especially hot summer here in the Northeast, the fall season has arrived and with it a welcome drop in temperature. We can picture many of you busily sending your children off to school or cleaning out your summer garden. In our office also, our summer interns recently delivered their final presentation and returned back to their schools.

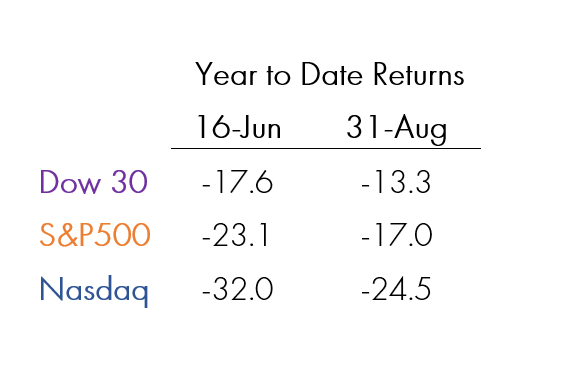

Following a punishing first half of the year, markets made a respectable recovery in July and August, although they are still in the red so far this year. After hitting their year-to-date lows in June, all three major indices have recovered some of their losses. The below table shows the year-to-date returns of each of the major indices at the market bottom on Jun 16th compared with the end of August.

It is impossible to know whether markets have hit their bottom and are on their way to long-term recovery or whether they will continue to dip further. Economically, there have been indications of both economic resilience and softening. While the GDP declined for the first and second quarter of 2022, meeting the informal definition of a recession, a strong labor market and growing wages have given economists pause from definitively declaring a recession. Still, there are signs that business and consumer spending is cooling and that the housing market has slowed under the weight of rising borrowing costs. Inflation has come down slightly, but in recent comments delivered at the Federal Reserve’s annual conference, Fed Chair Jerome Powell indicated that the central bank will continue raising rates until inflation is under control.

As the markets and global economies buckle and shift, investors often feel the need to react and shield their investments from further decline. Whether it is moving out of equities and into defensive asset classes or liquidating entirely and holding cash, fear can precipitate misguided responses. One reason we consider these moves ill-advised is that bear markets usually end well before news headlines turn positive. During the global financial crisis, the market hit its bottom in March 2009, even as the recession continued into the summer and unemployment rose to its peak of 10% in October of that year. Nevertheless, the S&P 500 climbed 63% from its bottom in March to finish 2009 with an annual net return of +23%.

A similar dynamic played out in 2020, with the outbreak of the COVID-19 virus. In March 2020, the Trump administration declared a nationwide emergency, issued travel bans on European countries, and states began implementing shutdowns across the country. Yet, even as cases and deaths climbed around the world and well before a vaccine was available, the market bottomed on March 23, 2020, and proceeded to stage a massive recovery.

Looking forward to 2023, it would be prudent to expect the markets to begin their recovery before the economic outlook observably improves. While none of us can predict the exact timing of a recovery, we know that missing any of its trading days could significantly compromise performance. As we have met with our fund managers over the past quarter, we have received a similar message: this downturn has impacted higher and lower-quality companies indiscriminately, even irrationally. However, past downturns have proven that as stock prices recover in the subsequent 1-3 years, we can expect stronger companies with cash-rich balance sheets and high free cash flow to distinguish themselves from the pack, especially in a higher interest rate environment. We are confident that in the long run, stock prices follow earnings growth and that we will be rewarded for our patience.

We know that sharp market fluctuations can be difficult to endure emotionally. What gives us confidence is that our investment selections are not based on price momentum or popular sentiment which can turn on a dime, but on the solid fundamentals of businesses that we believe are best positioned to withstand fluid economic conditions and emerge as winners on the other side.

We want to assure you that as a team, we are committed to providing you with the best advice, research, and execution as we navigate this challenging market together. As always, we welcome your thoughts, questions, or concerns. Thank you for your continued partnership.

JSO Partners Team

Contact Us

(215) 283-3131

team@jsopartners.com